Elliott Wave Explained Robert Beckman Pdf

Elliott Wave Explained Beckman Robert an introduction to the elliott wave principle - the london bullion market association page 12 beginning with robert.

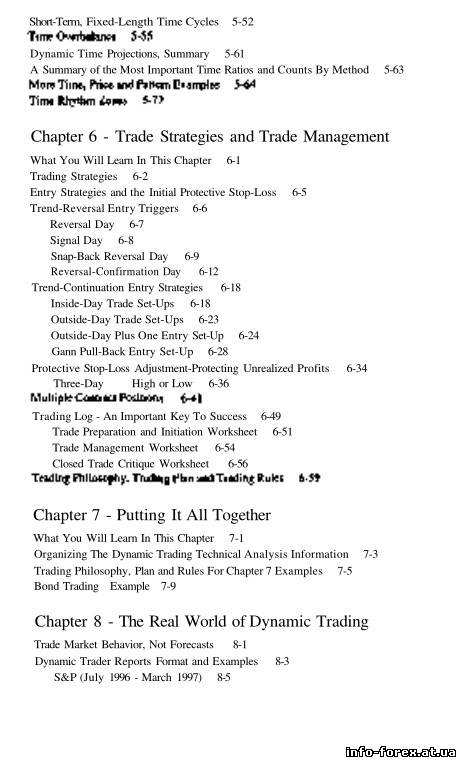

Publisher's Preface Introduction One: The Origins of the Wave Principle First contacts with Wall Street Elliott and the Economists The Grand Super Cycle The Five-wave Concept The Need to be a Genius? Two: Reality in the Stock Market $2,000 to $1,000,000 The Future not the Past Cyclical Nature of the Market Time Frame Relative - not Fixed Classification of Waves Three: Elliott. Pure and Simple A Rhythmic Pattern of Waves Elliott's Five Basic Tenets Bull Market - Bear Market Ground Rules Application to Investment Strategy Probabilities not Absolutes Practice Runs Four: 'Like a Circle in a Spiral, a Wheel within a Wheel' The Wave Count Breakdown of Primary Market Cycle Pivotal Points 1984 Normality and Variations The Market is Always Right Improving Investment Performance Five: The Fibonacci Summation Series The Series W.

Gann's Numerical Approach The Fibonacci Series in Art and Nature Examples from Nature's Law Fibonacci and Cyclical Behaviour Brilliant. Or Ludicrous? Open Mind - Successful Investment Six: Applying the Fibonacci Series Choice of Stock Exchange Data A Psychological Phenomenon Pattern Time Ratio Calculations and Examples The 'Non-Absolute' Nature of Elliott Stock Market History and the Summation Series Seven: The Trend Channel Logarithmic and Arithmetic Scales Forecasting using Trend Channels Frames of Reference, not Predictions Deviations from 'Normative' Behaviour F.T.30, January 1975-February 1976 Eight: Elliott, Inflation and the Fifth Wave Inflation in Britain Inflation in the U.S.A. And Fibonacci Early Warnings of Inflation Extensions Extensions of Extensions Retracements and Double Retracements Double Retracement and the Extended Fifth Wave Nine: Incorrigible Behaviour Extensions in the Corrective Phase Corrective Wave Formations - 'Zigzag' Maximum Corrective Action Use in Investment Strategy Further Corrective Wave Formations The 'Flat' 'Irregular Corrections' Ten: 'Double Threes', 'Triple Threes', 'Horizontals', 'Triangles'. And all that!

The classic work on Elliott Wave and market cycles returned to print During the 1930s, R. Elliott undertook the painstaking procedure of attempting to classify share price movements for the preceding 80 years on Wall Street. It was during the course of this seminal work that Elliott discovered a definable basic rhythm in share price movements which he felt had forecasting value when correctly applied. In 1938 Elliott published his findings in a series of articles with the overall title 'The Wave Principle'. After publication, Elliott's work drifted into obscurity, until Robert Beckman's 'Supertiming' introduced it to a new audience.

In this renowned work, Beckman sets out with three main objectives: 1. To clarify obscurities and grey areas of The Wave Principle that were present in Elliott's original writing. To incorporate the work of other analysts in order to allow the Wave Principle to have a broader application. To show the correct conceptual approach that should be used with the Wave Principle so that one can apply it with confidence and consistency. If you are willing to approach the subject of stock market behaviour with an open mind, who have faith in the fundamental laws of economics and the consistency of human nature, and who would like to avoid the pitfalls that have deluded the investment community for decades, this is the book for you. By requesting this free eBook, you agree to let us email you about future Harriman House offers and offers from carefully selected third parties.

We will not pass your details to any third parties and you can un-subscribe from the emails at any time. A valid email is required for us to send you the download link. Mailing Permissions Harriman House Ltd will use the information you provide on this form to keep in touch with you and to provide updates and marketing.

Please confirm that you are happy to receive: Emails from Harriman House with Harriman House offers Emails from Harriman House with carefully selected third party offers You can change your mind at any time by clicking the unsubscribe link in the footer of any email you receive from us, or by contacting us at newsletter@harriman-house.com. Karta rossii shp. We will treat your information with respect. For more information about our privacy practices please visit our website.

By clicking below, you agree that we may process your information in accordance with these terms. We use MailChimp as our marketing automation platform. By clicking below to submit this form, you acknowledge that the information you provide will be transferred to MailChimp for processing in accordance with their Privacy Policy and Terms.